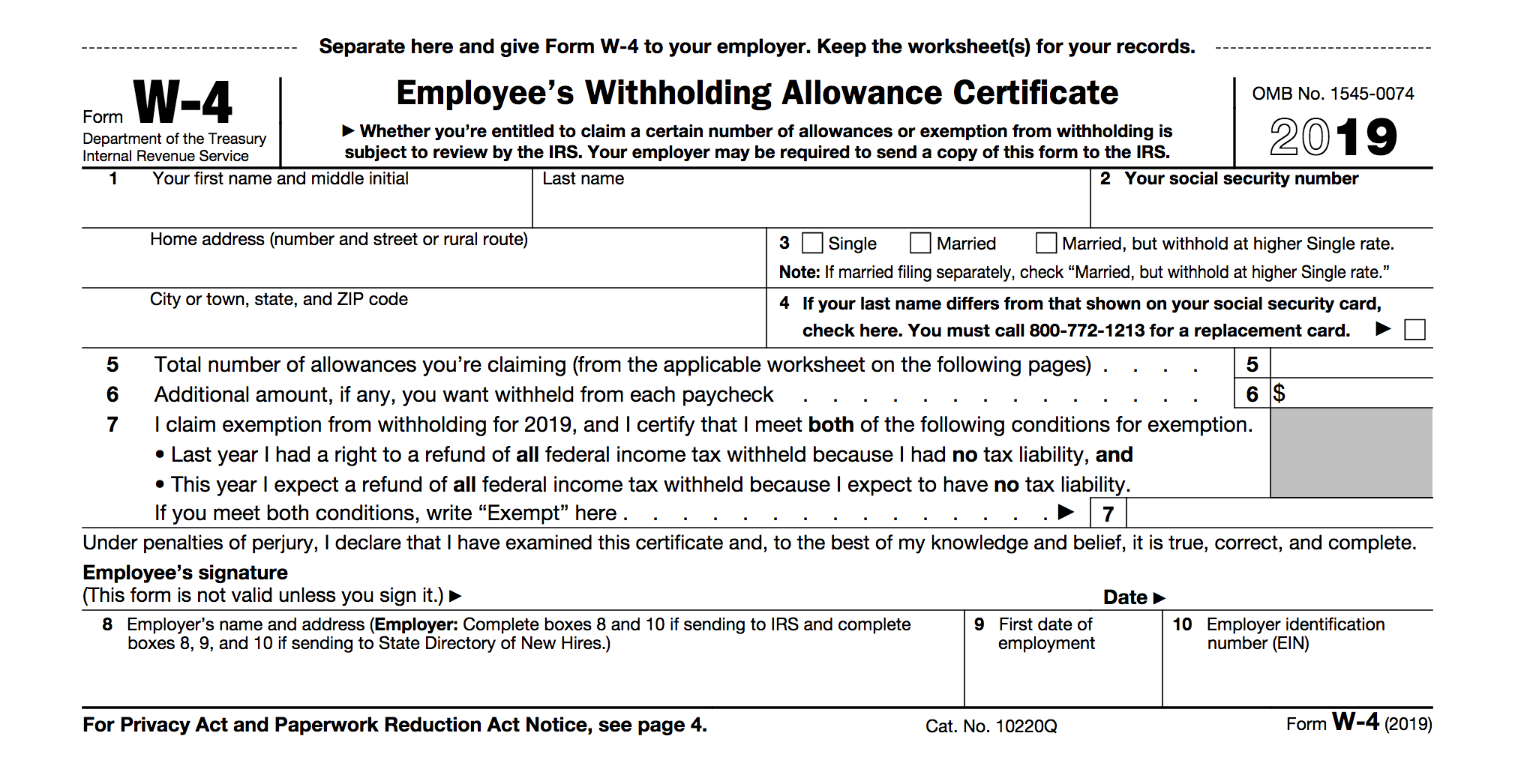

Annual gross rental income loss The remaining 25 accounts for vacancy loss maintenance and management expenses. Start by completing the worksheet that comes with the W-4.

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Employee Tax Forms Tax Refund

When using this worksheet to determine modified taxable income for a carryback year the references to Form 1NPR.

W2 deductions worksheet. We take your gross pay minus 4050 per allowance times this percentage to calculate your estimated. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. For each employer you worked for you will receive a W-2 statement.

Income calculation worksheet ytd salary paytsub past year ot breakout use lowest income average date w2 for tax year. Deduct from each employees paycheck based on that persons situation such as whether he or she is married or single. For example 12 for monthly 26 for biweekly or 52 for weekly.

C lear formatting Ctrl. Many high-earners will still itemize however so proceed accordingly. Subtract your standard deduction from the total of your itemized deductions.

Fannie mae publishes four worksheets that lenders may use to calculate rental income. Section 4 of the W-4 is a bit more open ended. This includes both itemized deductions and other deductions such as for student loan interest and IRAs.

Enter in this step the amount from the Deductions Worksheet line 5 if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions. Except for meals is deducted at the same rate. You then put this total on the form.

If you are already a member to Money Instructor then click here to sign-in. Even if you are a student it isnt likely that you are exempt from tax withhold ings. Since the TCJA increased the standard deduction way fewer people will itemize their deductions.

The deductions worksheet is for anyone who plans to itemize deductions. State and local taxes. This worksheet allows you to itemize your tax deductions for a given year.

Here youll be able to state other income and list your deductions which can be used to reduce your withholding. Please sign-in to view. Sort sheet by column A Z A.

For teaching and learning the W-2 Tax Form. Use the worksheet on page 3 of the W-4 to figure out your deductions. If it goes in the wrong category it does not affect the bottom line.

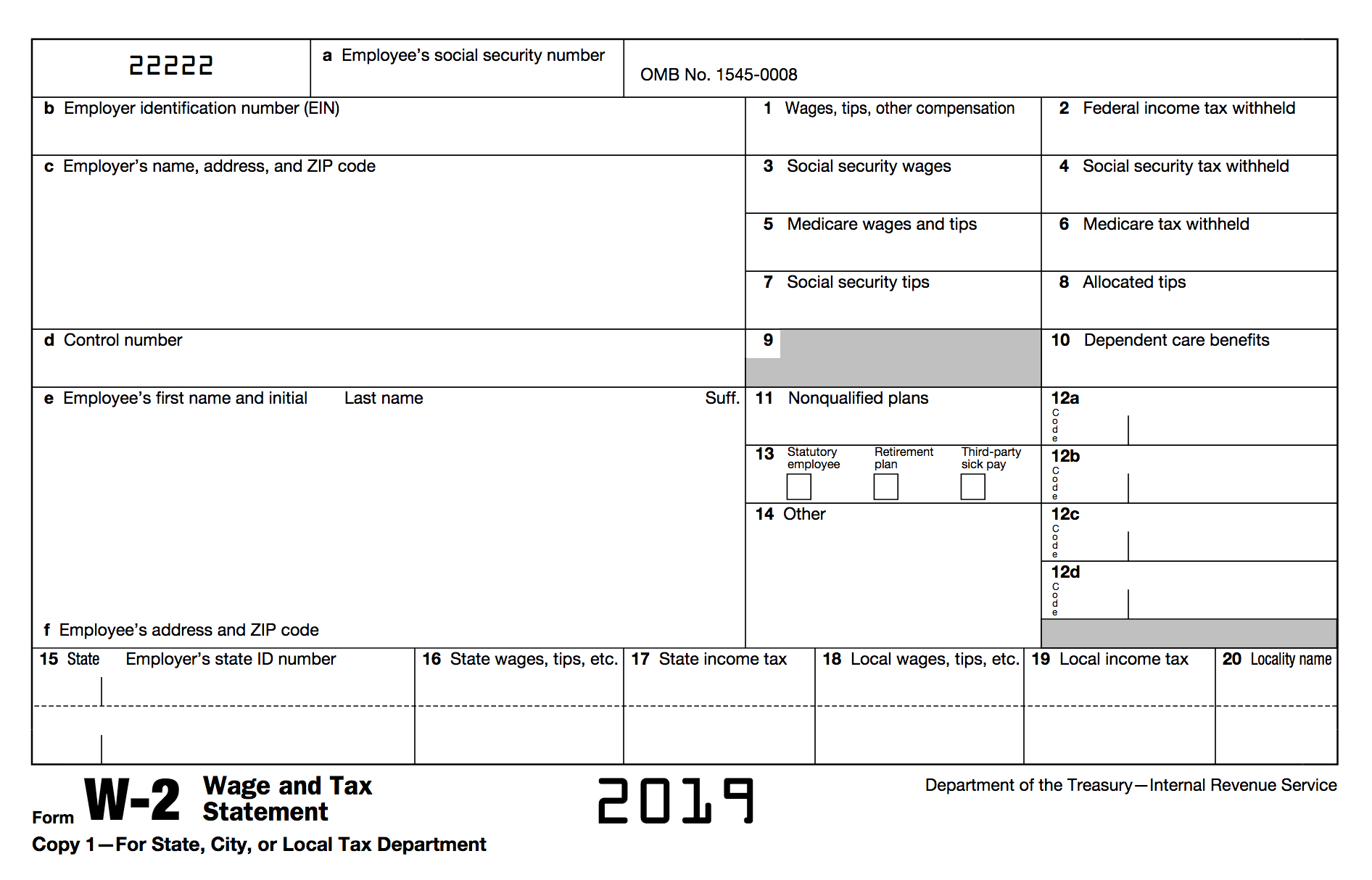

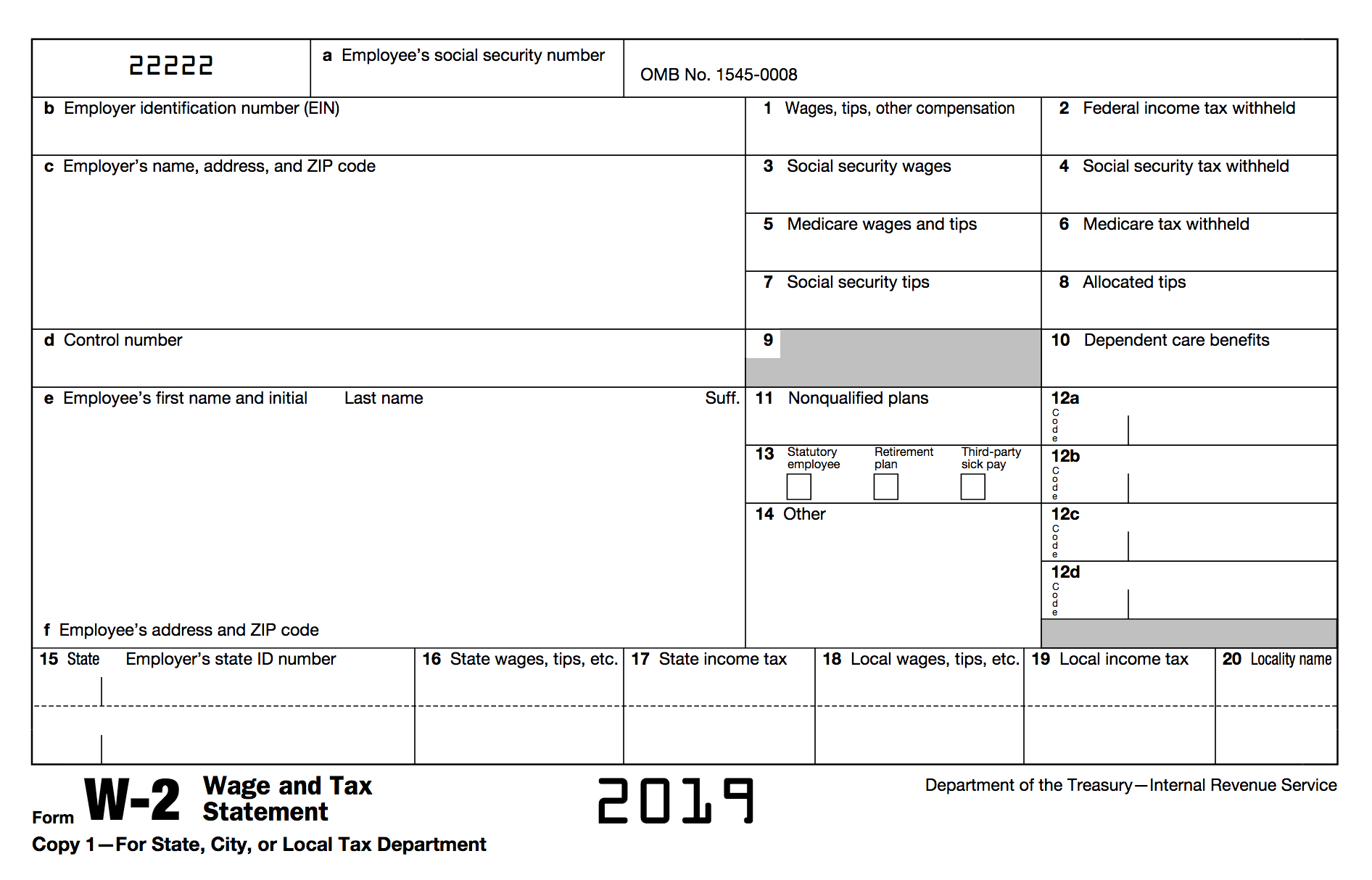

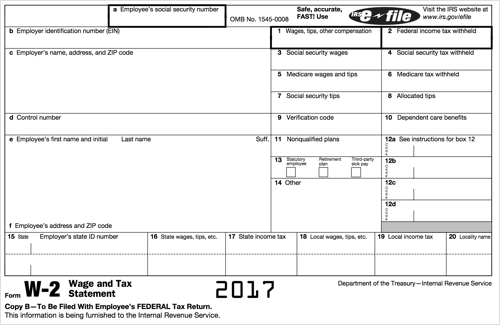

Your dependent should write a zero on line A. The W-2 is a wage and tax statement since it shows income and taxes paid during the year. Taxes and the IRS W2.

Sort sheet by column A A Z. W-2 Tax Worksheet - W2 Tax Form. If you also get a W2 for this same line of work you must split expenses between this form and an Unreimbursed Employee Expense form.

Discover learning games guided lessons and other interactive activities for children. Tax Deduction Worksheet. The worksheet can be used for 2014-2017 by using comparable lines and the appropriate Wisconsin standard deduction for each year.

Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE _____ Accountant. Leave lines C to G blank. Finally you can also use the extra withholding section to make your total withholding as precise as possible.

Enter the total on line H. For example if you are married filing jointly in 2011 your standard deduction equals 11600 so subtract 11600 from 21000 to. The W-2 lists the taxes withheld by your employer.

Sor t range by column A Z A. If you would like to gain access to our material then. Once you have this amount you add any student loan interest deductible IRA contributions and certain other adjustments.

Credits. The standard deductions are listed on the Deductions and Adjustments Worksheet. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Discover learning games guided lessons and other interactive activities for children. This is the percentage that will be deducted for state and local taxes. Each employee must receive this form by their employers at the beginning of the year.

Each April anyone who earned income must file a federal income tax return with the IRS. Youll need to enter the number of pay periods in a year at the highest paying job on line 3 of the Multiple Jobs Worksheet. Text r otation.

If you claimed more than the standard amount this worksheet will help you calculate how much more. He enters 1 on line B unless he expects to earn more than 1500 from a second job. This will be 1 or zero.

So r t range by column A A Z. Only put expenses here that correspond to the income categories above. A l ternating colors.

Instructions for Worksheet 2 Wisconsin Modified Taxable Income Note.

Form W2 2013 Fillable How To Fill Out Irs Form W 2 2017 2018 Irs Forms Power Of Attorney Form W2 Forms

W 2 Vs W 4 What S The Difference Seek Business Capital

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Tax Prep Checklist Tracker Printable To Stay Organized By Etsy Tax Prep Checklist Tax Prep Tax Checklist

Fillable W2 Form 2014 How To Fill Out The Most Plicated Tax Form You Ll See Deduction Tax Forms W2 Forms

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

Get Organized For Tax Season In 2021 Tax Season Filing Taxes Working Mom Life

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Student Loan Interest Tax

Spreadsheet123 Excel Templates Spreadsheets Calendars And Calculators Salary Calculator Paycheck Payroll Template

My Favorite Tax Organization Tips Printable Checklist Crazy Organized Tax Organization Tax Prep Checklist Tax Checklist

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Irs Forms Tax Consulting Tax Preparation

W 2 And W 4 A Simple Breakdown Bench Accounting

How To Fill Out A W 2 Tax Form For Employees Smartasset

W 2 And W 4 A Simple Breakdown Bench Accounting

Pin By Lance Burton On Unlock Payroll Template Money Template Money Worksheets

How To Read A W 2 Form Infographic H R Block Business Tax Tax Help Money Management

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Teaching Teens

2019 Irs Form W 2 Downloadable And Printable Cpa Practice Advisor

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

0 comments: